Rents Are Increasing Rapidly in These States Despite Flattening Nationally

Share this post:

Other posts:

Spring and summer typically witness an increase in rent prices as more individuals search for new rental homes. However, nationwide, rent prices have remained relatively stable due to a combination of lower demand and an influx of new rental properties. Nevertheless, certain states have experienced a rise in median rents due to an influx of new residents, as highlighted in a May report from Rent.com. The prevailing trend indicates that people are relocating to areas with robust economies that still offer affordable rent and housing options. Even in states with the fastest year-over-year rent increases, the median rent remains comparatively low when compared to the national median.

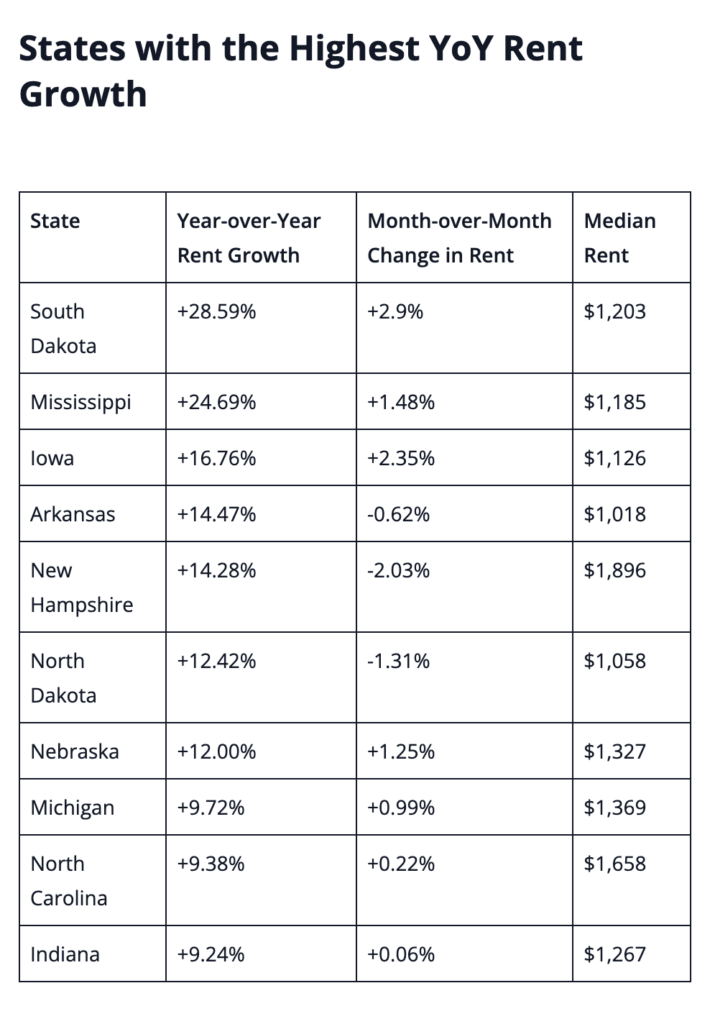

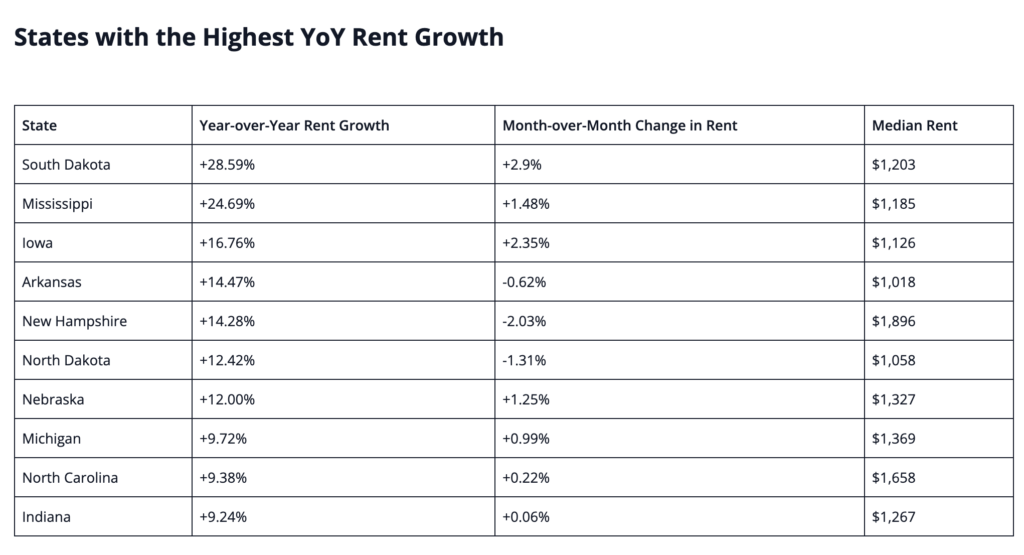

In April, national rents saw a mere 0.29% year-over-year increase. From March to April, there was a month-over-month decrease of -0.23%, following a 1.77% upswing from February to March. Currently, the national median rent stands at $1,967. Although the rate of decline has slowed, it is uncertain whether the national median rent has reached its lowest point. Nevertheless, nearly 79% of markets continue to experience year-over-year rent growth. Some Southern and Midwestern states have witnessed double-digit rent increases. Interestingly, all ten states with the highest rent price growth maintain median rents below the national average. With the exception of New Hampshire, most of these states are located in the South and Midwest. South Dakota leads the pack with a staggering year-over-year increase of almost 29% and a month-over-month increase of 2.9%. This surge in rents is attributed to rising housing costs and property taxes, particularly in cities like Sioux Falls, which are attracting a significant influx of new residents.

The national rental market has experienced a cooling effect on rent increases due to an increase in the supply of multi-family housing units. Additionally, concerns about a potential recession have dampened the demand for rental properties as more individuals opt to stay in their current homes or share living spaces with family or roommates. This trend may persist, particularly if the U.S. economy enters a recession. The rental market shares the same uncertainty as the housing market, although some investment firms are speculating on a long-term rental boom in 2024 and showing interest in build-to-rent developments as promising investment opportunities.

In summary, rent prices have fluctuated since the previous autumn but have remained relatively stable year-over-year. The sales of existing homes have also experienced fluctuations, and uncertainty looms over the future of the U.S. economy. The Federal Reserve could potentially achieve a controlled economic slowdown, or unemployment rates may rise, leading to further declines in housing prices. Investors should diligently analyze all available information, including changes in rent prices, to make informed predictions about individual markets. It is crucial for them to prepare for various outcomes and approach investment decisions with contingency plans in place.

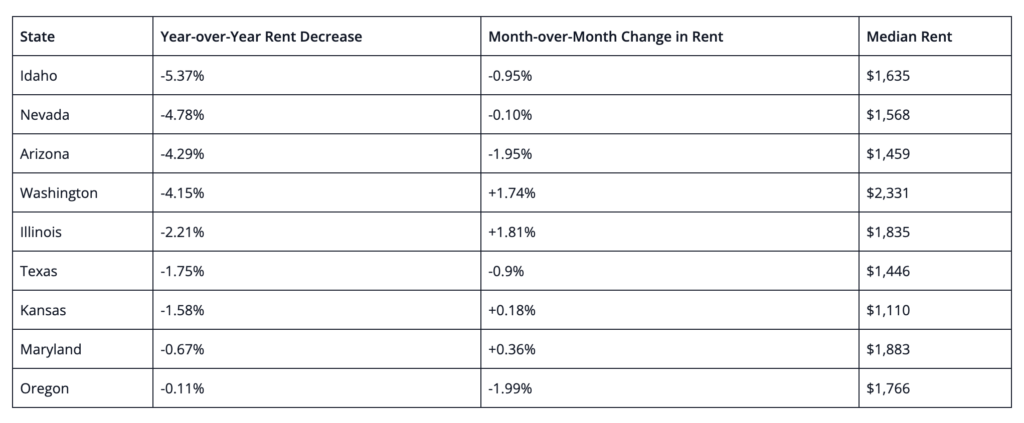

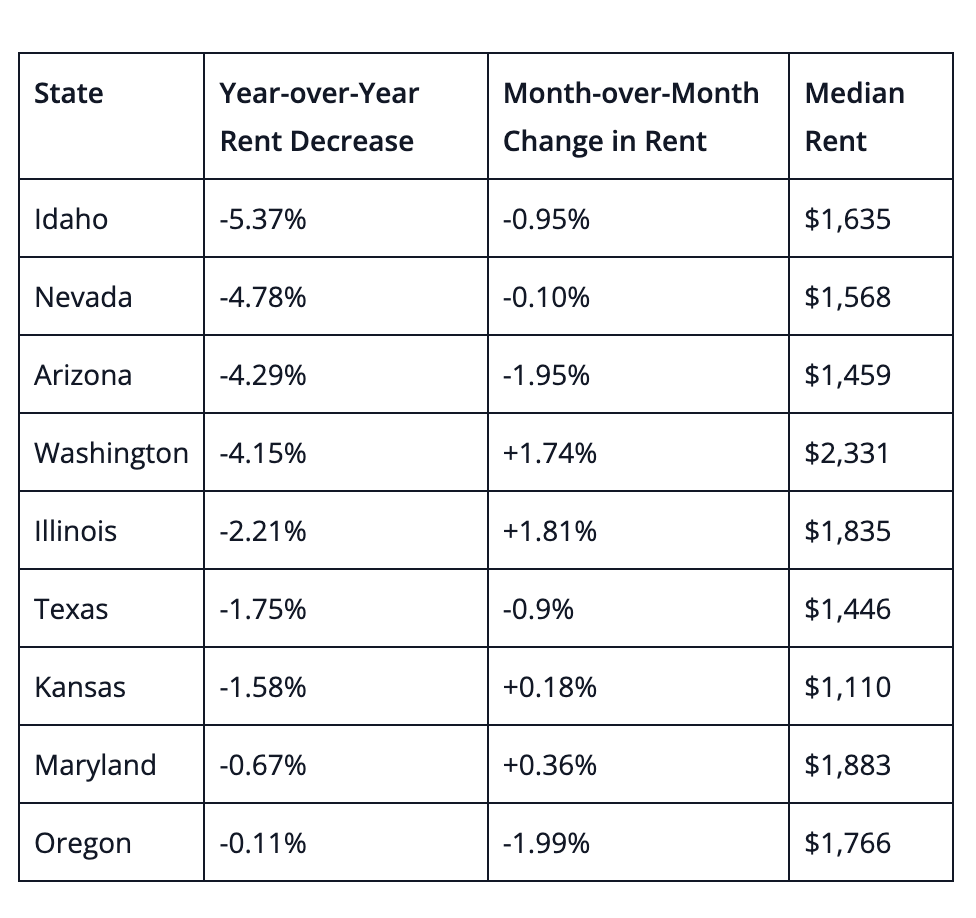

The following states have seen the largest year-over-year decreases in rent prices across their cities, totaling only nine states. In various Mountain West states, rents are cooling off after a surge in migration during the early stages of the pandemic. For instance, cities such as Phoenix and Austin experienced a pandemic-driven boom, and now rent prices are declining, consequently impacting their respective states. California, notorious for its high rents, has experienced a stagnant year-over-year rent market, while Florida, New York, and Tennessee have witnessed rent increases. Although rent prices have decreased year-over-year in only about 21% of markets, nearly 43% have experienced a decline on a monthly basis.

The national rental market has experienced a cooling effect on rent increases due to an increase in the supply of multi-family housing units. Additionally, concerns about a potential recession have dampened the demand for rental properties as more individuals opt to stay in their current homes or share living spaces with family or roommates. This trend may persist, particularly if the U.S. economy enters a recession. The rental market shares the same uncertainty as the housing market, although some investment firms are speculating on a long-term rental boom in 2024 and showing interest in build-to-rent developments as promising investment opportunities.

In summary, rent prices have fluctuated since the previous autumn but have remained relatively stable year-over-year. The sales of existing homes have also experienced fluctuations, and uncertainty looms over the future of the U.S. economy. The Federal Reserve could potentially achieve a controlled economic slowdown, or unemployment rates may rise, leading to further declines in housing prices. Investors should diligently analyze all available information, including changes in rent prices, to make informed predictions about individual markets. It is crucial for them to prepare for various outcomes and approach investment decisions with contingency plans in place.