Rents Are Increasing Rapidly in These States Despite Flattening Nationally

Rents Are Increasing Rapidly in These States Despite Flattening Nationally Conforming Loan About Conforming Loans Conforming Loan Requirements Conforming Loan...

One of the first things you will notice about our professionals is the passion they bring to their business. We are not interested in just “doing the loan.” With the mortgage industry constantly evolving, properly structuring your mortgage is the first step in our strategy to maximizing your assets while working together to create wealth.

A mortgage is no longer just a Mortgage, and must be seen as part of your overall debt management strategy and an integral part of your financial plan. Our team is committed to providing expert advice to you and your family in order to protect one of your most valuable assets – your home.

Rents Are Increasing Rapidly in These States Despite Flattening Nationally Conforming Loan About Conforming Loans Conforming Loan Requirements Conforming Loan...

What Are CONFORMING LOANS? Conforming Loan About Conforming Loans Conforming Loan Requirements Conforming Loan Limits Out Loan Details Share this...

MORTGAGE CLOSING TIME Mortgage Closing Time How Long after the Appraisal to Close the Mortgage? Mortgage Closing Times Share this...

•LTV up to 95% (MI applies for LTV > 80%)

•Minimum FICO 660

•“Full Doc” with up to 50% DTI

•W2 or Self Employed Borrowers

•Purchase Loan, Rate and term, or Cash-Out refinance

•Current conforming limit in CA for a single-family unit is $548,250. High Balance Conforming loan limits vary for each county

•Restrictions apply. Rates are subject to change without notice

Rates as of 09/18/23 and are subject to change. The following examples are for a Purchase for well-qualified “full doc” borrower with a mid-FICO score of 660+, and property Loan-to-Value (LTV) ratio up to 60%. Conforming 15-year Fixed-Rate loan example is based on $400,000 loan amount at 4.99% (APR 5.19%), Principal and Interest monthly payment (P&I) is $3,161, estimated financial charges: $5,200. P&I payment does not include taxes, home insurance premium, and HOA dues, which will result in a higher total monthly payment.

•LTV up to 95% (MI applies fo LTV > 80%)

•Minimum FICO 660

•“Full Doc” with up to 50% DTI

•W2 or Self Employed Borrowers

•Purchase Loan, Rate and term, or Cash-Out refinance

•Restrictions apply. Rates are subject to change without notice

• Click here for Confroming Loan Limits

Rates as of 09/18/24 and are subject to change. Following examples is for a Purchase for well-qualified “full doc” borrower with a mid-FICO score of 660+, and property Loan-to-Value (LTV) ratio up to 60%. Conforming 30-Year Fixed-Rate loan example is based on $400,000. loan amount at 5.5% (APR 5.63%), P&I is $2,271 estimated loan costs: $5920 . P&I payment does not include taxes, home insurance premium, and HOA dues, which will result in a higher total monthly payment.

•LTV up to 89.9%

•Minimum FICO 680

•“Full Doc” with DTI up to 45%

•W2 employed or Self Employed Borrowers

•Purchase Loan, Rate and Term, or Cash-Out refinance

•Loans up to $3 Million

•Reserves: 6 to 12 months of PITI

•Restrictions apply

•Rates are subject to change without notice

Rates as of 09/18/24 and are subject to change. The following example is for a Purchase for well-qualified “full doc” borrower with a mid-FICO score of 760+, and property Loan-to-Value (LTV) ratio up to 60%. Jumbo 30-Year Fixed-Rate loan example is based on $1,200,000 loan amount at 5.875% (APR 5.99%) P&I is $8,873, estimated loan costs: $18,000. P&I payment does not include taxes, home insurance premium, and HOA dues, which will result in a higher total monthly payment.

Rates as of 09/18/24 and are subject to change. Following examples are for a Purchase for well-qualified “full doc” borrowers with a mid-FICO score of 740+, and property Loan-to-Value (LTV) ratio up to 60%. Conforming 30-Year Fixed-Rate loan example is based on $400,000 loan amount at 5.875% (APR 6.02%), P&I is $2,366 , estimated loan costs: $6,400. P&I payment does not include taxes, home insurance premium, and HOA dues, which will result in a higher total monthly payment.

•Business Deposits verified by 12-24 months of

Bank Statements

•LTV up 90% for Purchase and R/T AND Cash-Out Refinances.

•Minimum FICO Score 580

•No Business or Personal Tax Returns!

•Available for Primary, Second Homes or Investment Properties

•30-Year Fixed and 5/7/10 ARM options

•Interest-Only payment options.

•Reserves: 6 to 12 Months of PITI

•Loan Amount Limits: $200,000 to $4,000,000

Rates as of 09/18/24 and are subject to change. The following example is for Purchase with 24 months business statements, averaging deposits to meet 43% DTI, a borrower with a mid-FICO score of 760+ and ACH direct payments, and property Loan-to-Value (LTV) ratio up to 60%. A 30-Year Fixed-Rate loan example is based on a $400,000 loan amount at 6.25% (APR 6.56%), P&I is $2,463 estimated loan costs: $11,950. Rates are subject to change. PI payment does not include taxes, home insurance premium, and HOA dues, which will result in a higher total monthly payment.

Available in California and Florida

•LTV up 75% for Purchase and Rate & Term Refinance. Up to 65% for Cash-Out Refinance.

•Minimum FICO credit Score: 640+

•No income or employment Documentation Required

•Just One Month bank statement for Proof of Funds

•Available for primary and second homes

•30-Year Fixed and 5/7/10 ARM options

•Interest-Only payment options.

•Reserves: 12 to 24 Months of PITI (Based on borrower’s FICO) – Cash-Out funds can be used as reserves!

•Loan Amount Limits: $200,000 to $3,000,000

•

LTV up 80% for Purchase and Rate & Term Refinance/ up to 75% for Cash-Out Refinances

•

Minimum FICO 620

•

P&L prepared by a licensed accountant required

•

Avaliable for primary and second homes

•

30 Year Fixed and 5/7/10 ARM options

•

Interest Only payment options

•

Reserves 6 to 12 months of PITI – Cash-Out funds can be used as reserves!

•

Loan Amount Limits: $200,000 to $3,000,000

Rates as of 09/18/24 and are subject to change. The following example is for Purchase with a Profit and Loss Statement prepared by a licensed accountant with a Net Income after expense ratio sufficient to meet 43% DTI, a borrower with a mid-FICO score of 760+ and ACH direct payments, and property Loan-to-Value (LTV) ratio up to 60%. A 30-Year Fixed-Rate loan example is based on a $400,000 loan amount at 6.5% (APR 6.76%), P&I is $2,528 estimated loan costs: $10,900. Rates are subject to change. PI payment does not include taxes, home insurance premium, and HOA dues, which will result in a higher total monthly payment.

Available in California and Florida

•LTV up 75% for Purchase and Rate & Term

Refinance. Up to 65% for Cash-Out Refinance.

•Minimum FICO credit Score: 640+

•No income or employment Documentation Required

•Just One Month bank statement for Proof of Funds

•Available for primary and second homes

•30-Year Fixed and 5/7/10 ARM options

•Interest-Only payment options.

•Reserves: 12 to 24 Months of PITI (Based on borrower’s

FICO) – Cash-Out funds can be used as reserves!

•Loan Amount Limits: $200,000 to $3,000,000

Rates as of 09/18/24 and are subject to change. The following example is for a Purchase loan in L.A County for a borrower with a mid-FICO score of 760+, 3 months of PITI in reserves, and property Loan-to-Value (LTV) ratio up to 60%, For 30 year Fixed option, loan amount of $400,000 at 8.75% (APR 9.08%), P&I is $3,146, estimated loan costs: $11,900.

Available in California and Florida

•LTV UP TO 75%

•Investment SFR’s, Condos, and 2-4 Uints

•NO ASSET VERIFIED

•CLOSE IN 10-21 DAYS*

•NO INCOME VERIFIED

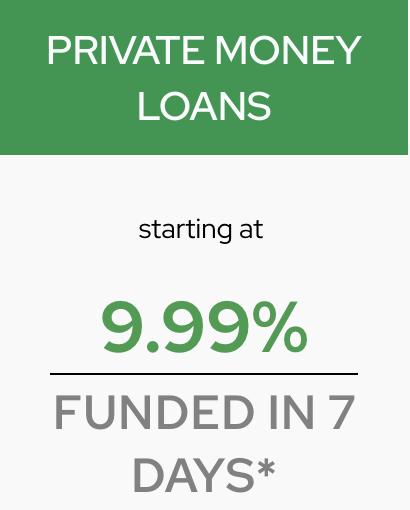

Rates as of 06/21/23 and are subject to change. *Some loans may take longer than 10 days to close. To qualify for the above sample rate, LTV up to 60%, borrower must be current on all mortgages. FICO 740+.Investment SFR’S 2-4 UNITS. Have atleast 6 verified experience 1st TD’sand non construction loans only. Origination fee of 2.5points, plus underwriting, processing, appraisal and prepayment penalty apply. N/O/O SFR’S and 1-4 unit only. Other programs with FICO requirement and up to 80% LTV are available, call for details. Restrictions Apply. Terms are subject to change, Loans are funded by Pacific Capital Funding Corp is licensed by Cal DRE Lic: 02039562

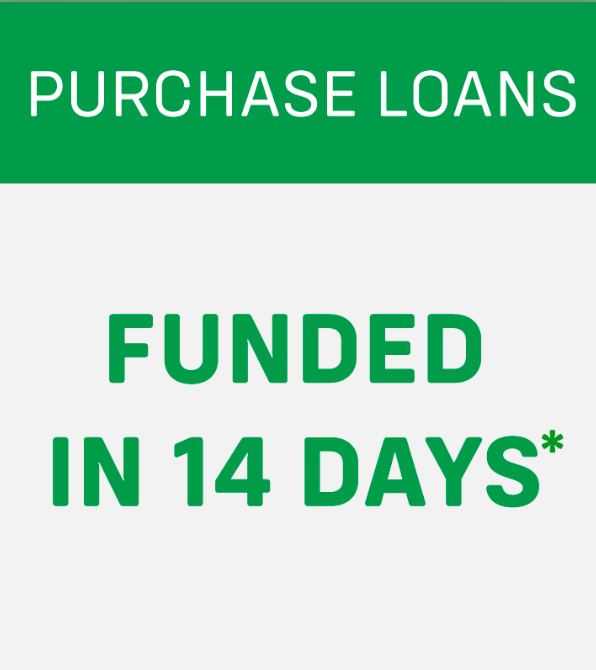

*Conforming and High Balance Conforming Purchase mortgage for W2 earners with no investment properties can be funded within 14 days from receipt of a complete loan package. Some loans may take longer to fund. Rates and turn times are subject to change without notice.